3 Things to Keep After Losing Your Job

Losing your job is stressful. Even with an emergency fund in place, it doesn’t take very long to feel the financial impact of a sudden loss of income. When recovering from income loss, the focus instantly shifts to finding a new job. Although the job hunt is an important part of overcoming a financial setback, it fails to address some of the less obvious consequences of losing your job. When you lose your job, you lose more than a regular paycheck—you also lose the routines, the socialization and even the sense of identity connected to that job. Ignoring the non-financial consequences of job loss can have a profound impact on your mental health and sabotage your recovery effort.

than a regular paycheck—you also lose the routines, the socialization and even the sense of identity connected to that job. Ignoring the non-financial consequences of job loss can have a profound impact on your mental health and sabotage your recovery effort.

In order to reduce stress and stay motivated, make sure that your income loss recovery plan addresses the financial and non-financial aspects of losing your job. When faced with income loss, make an effort to keep the following:

1. Keep your routine

When you lose your job, you also lose the regular routines that support that job—including everything from setting your alarm to your commute home at the end of the workday. These daily rituals may not seem significant to you, but they do help structure your day and provide you with natural cues to focus and to relax. Without them, it’s easy to feel lost and uninspired.

Recovery Tip:

Make an effort to hold onto your daily routine, even after you’ve lost your job. Wake up at the same time, take your breaks at the same time and replace your work tasks with tasks related to your job search. Sticking to a routine ensures you’re making progress on your recovery plan every day without letting it overwhelm you.

2. Keep your sense of identity

2. Keep your sense of identity

We live in a very work-oriented culture. We describe ourselves using our job titles, and we turn to our work for a sense of purpose and pride. It can be challenging to separate the work we do from our sense of self. As a result, a sudden job loss can feel like a personal failure instead of a temporary circumstance.

Recovery Tip:

Reflect on your personal goals and consider the fact that you can find meaning both within and outside of your work. Dedicate time each day to pursuing your interests, whether that means taking an online course, doing some volunteer work or simply enjoying a hobby. Engaging in activities you’re passionate about will keep you energized and grounded as you work toward financial recovery.

3.Keep your social life

Your job is a source of social connection. Whether it’s a formal meeting or a casual break room chat, the typical workday is filled with social interaction. When you are suddenly cut off from those regular interactions, you may feel increasingly isolated and lonely. Neglecting your social needs can lead to even more stress.

Recovery Tip:

Even though the circumstance may be stressful, reach out to the people in your life who love and support you. Spend some quality time with your family and friends. To further ease the stress and rebuild confidence, create the opportunity for more social engagement outside of work. Volunteering or joining a club is a great way to make new friends and expand your network.

Losing your job can greatly affect your daily routine, your sense of self and your social network. Although these aspects seem less urgent than the financial consequences of losing your job, they play an important role in your overall well-being. By responding to both the financial and non-financial setbacks related to job loss, you can minimize the obstacles on your path to recovery.

Activity

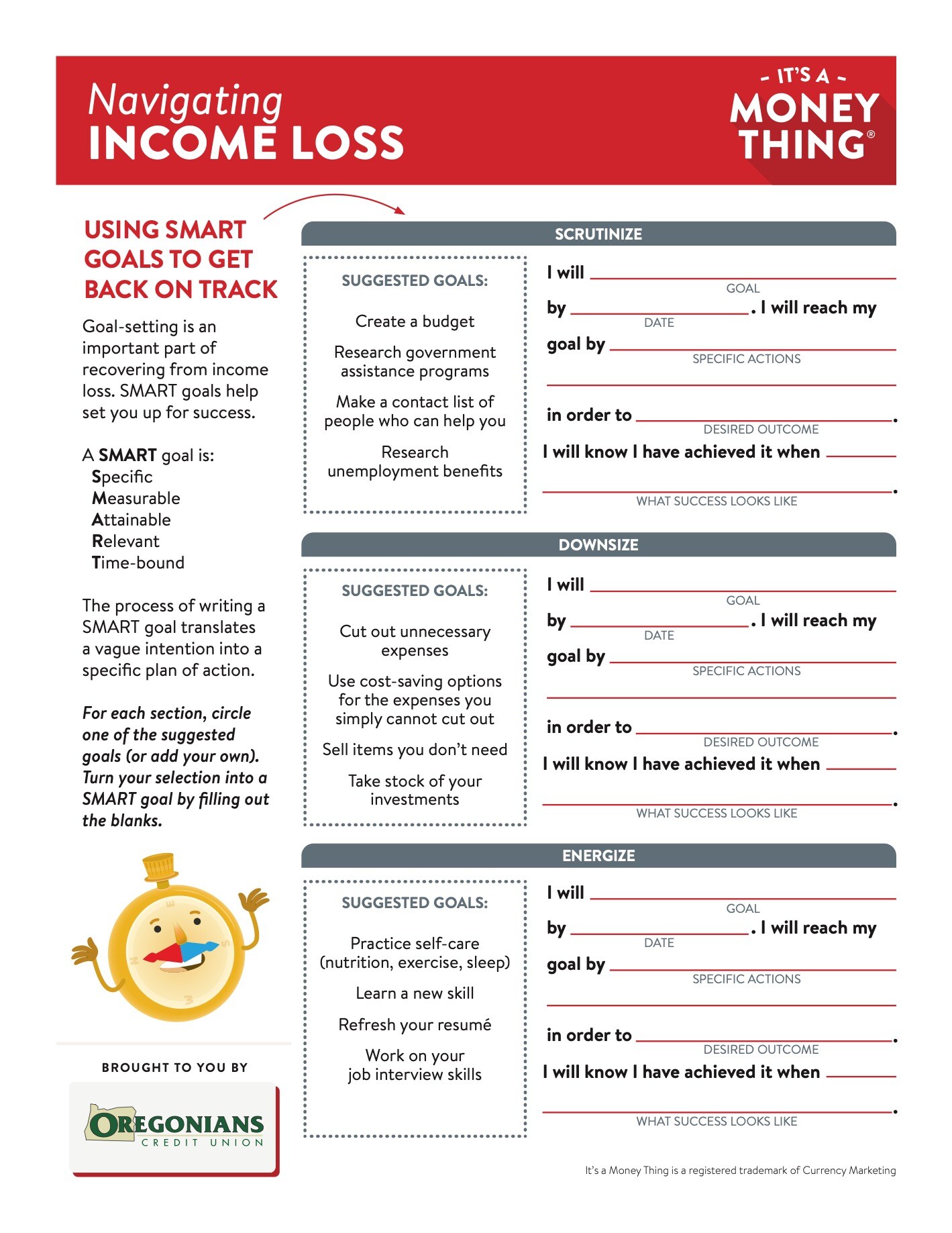

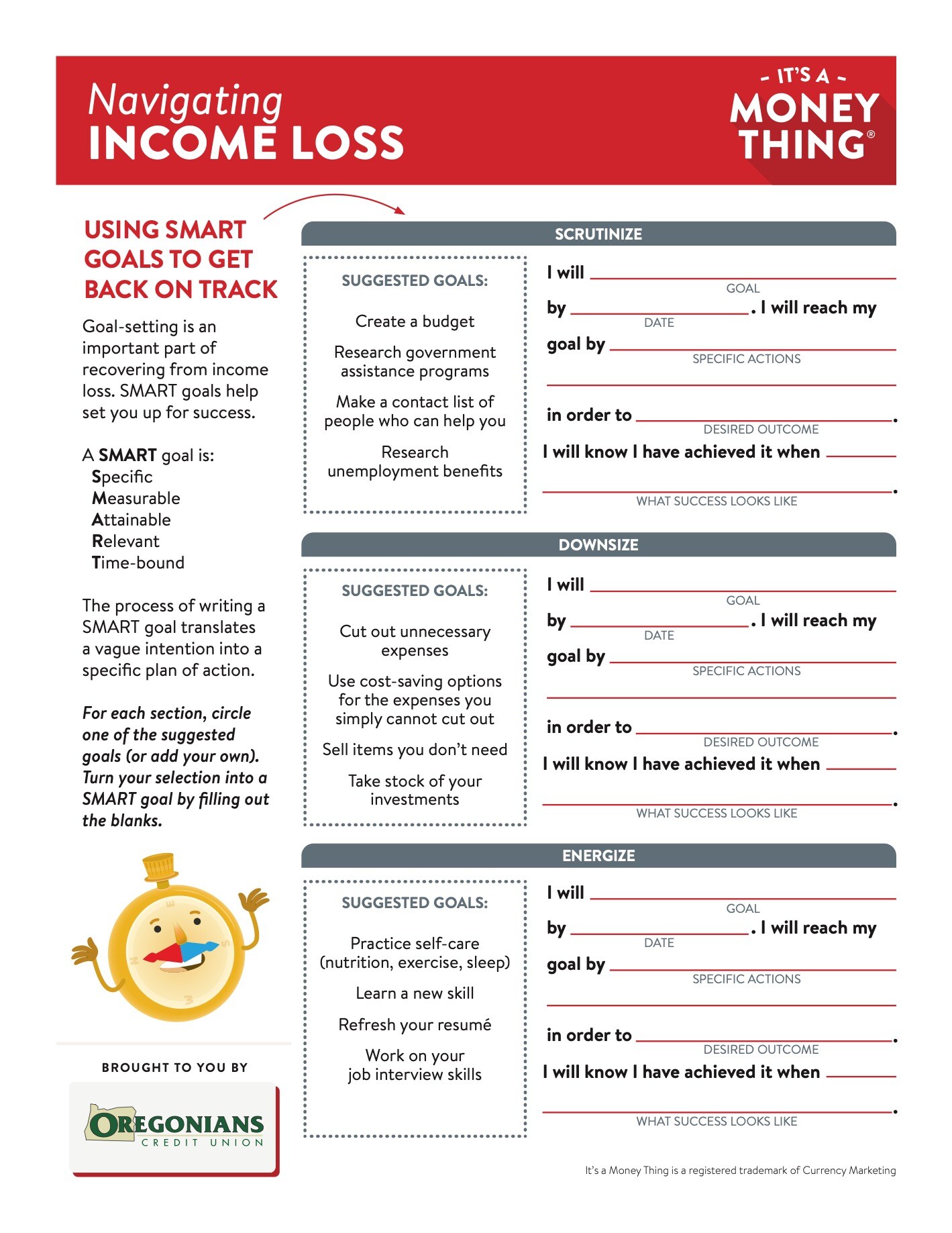

Goal-setting is an important part of recovering from income loss. SMART goals help set you up for success. Download the PDF version.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.

than a regular paycheck—you also lose the routines, the socialization and even the sense of identity connected to that job. Ignoring the non-financial consequences of job loss can have a profound impact on your mental health and sabotage your recovery effort.

than a regular paycheck—you also lose the routines, the socialization and even the sense of identity connected to that job. Ignoring the non-financial consequences of job loss can have a profound impact on your mental health and sabotage your recovery effort. 2. Keep your sense of identity

2. Keep your sense of identity